Introducing the AI Engine for Insurers, Brokers, and Intermediaries

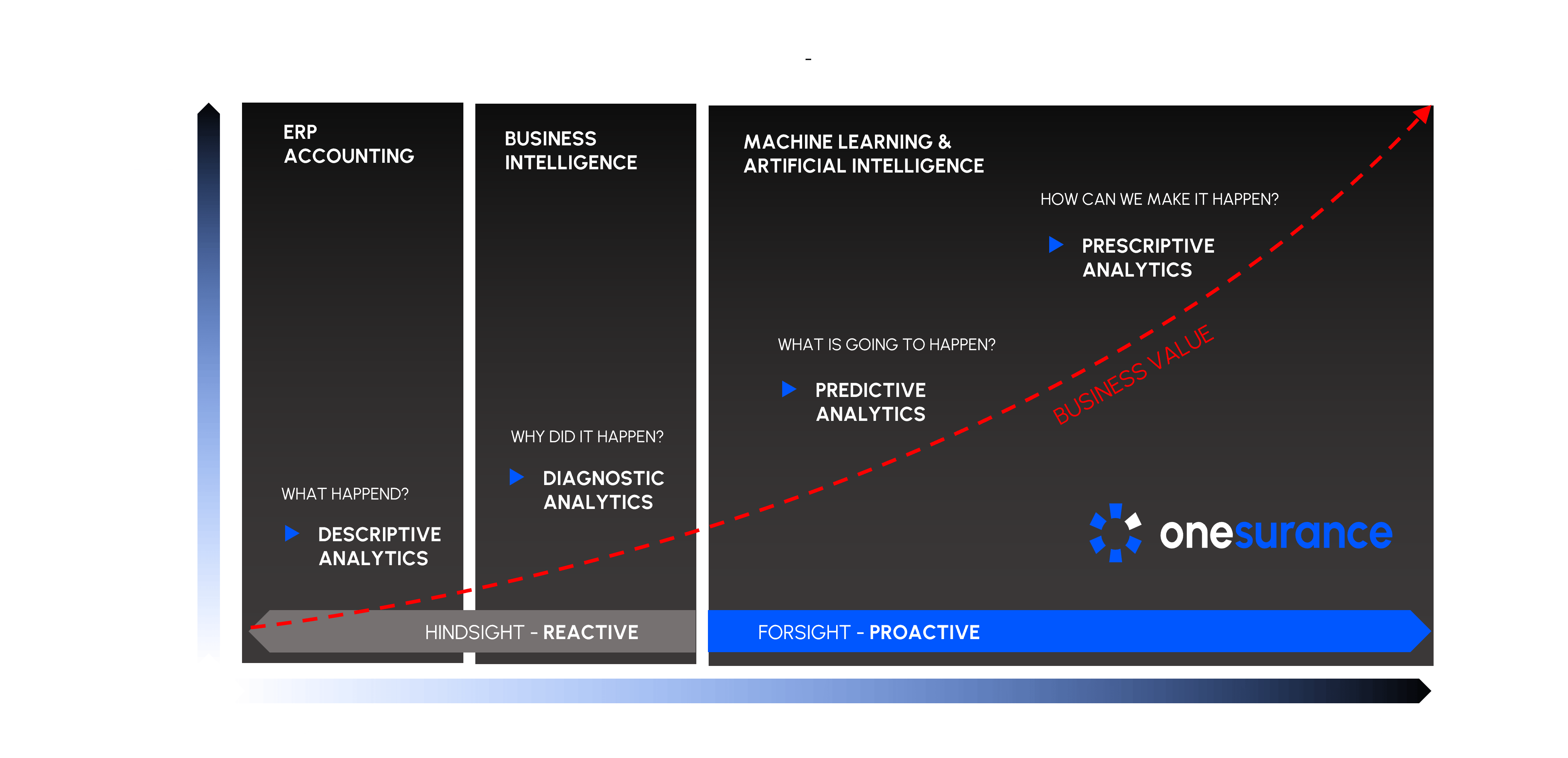

In today’s competitive insurance market, effectively leveraging your data is essential for staying ahead. According to a study by Cap Gemini, only 30% of insurers are considered ‘Data Masters,’ yet these organizations are 175% more productive and 63% more profitable than their peers. Most insurance companies still operate at a descriptive level of data maturity, making decisions based on historical data—like driving using only the rearview mirror. Advancing to diagnostic, predictive, and prescriptive analytics is challenging without specialized knowledge, experience, and tools.

Our AI Engine changes the game, eliminating the need for in-house expertise and providing advanced, future-focused, data-driven decision-making capabilities.

Solving Your Most Pressing Challenges

Problem: Many insurers struggle to fully utilize their data, resulting in missed opportunities for improving productivity and profitability.

Solution: The Onesurance AI Engine systematically and continuously analyzes your data using sophisticated algorithms hosted in our secure cloud. We deliver high-quality, actionable predictions directly into your front-end applications.

Key Deliverables

Reduce Churn

Predict which customers are likely to cancel their policies and take proactive measures to retain them.

Enhance Advisor Efficiency

Enable your advisors to focus on the most valuable tasks.

Improve Combined Ratios

Optimize operational efficiency and reduce costs.

Increase Policy Density

Identify opportunities for cross-selling and up-selling.

Boost STP Acceptance

Improve straight-through processing rates for new policy applications

Ensure Compliance and Duty of Care

Maintain high standards of customer care and regulatory

Streamlined Implementation

Our approach is straightforward yet highly effective

- API Integration: We connect to your back-end data sources using APIs

- Data Extraction: We use only relevant data extracts, minimizing the handling of personal data

- Secure Hosting: Your data is securely hosted in isolated containers.

- Data Transformation: Intelligent software converts your data into usable input for our algorithms.

- Prediction Accuracy: We monitor and validate the accuracy and reliability of our predictions.

- API Delivery: Predictions are delivered to your front-end applications in the agreed quantity, quality, and frequency.

- Algorithm Retraining: Periodic retraining ensures our models remain accurate and effective.

- Reporting: Regular reports provide insights into the quantity and quality of predictions

Real-World Application: Personalized Customer Management

Personalized Customer Management

Our churn prediction and customer lifetime value modules enable precise segmentation and prioritization of your customer base. Focus on retaining high-value customers and tailor strategies for different segments.

Get in Touch

Getting Started with Personalized Customer Management

Leverage our Exploratory Data Analysis to understand your portfolio and identify improvement areas. Integration with all back office systems provides a solid foundation for your active customer management strategy. With our prescriptive analytics we provide you with a monthly update on your :

- TOPDEFEND customers; these customers have the highest predicted churn rates and the highest customer lifetime value and should get attention right away

- DEFEND customers; these customers are “at risk” while they are your most profitable customers based on a customer lifetime value prediction

- ENLARGE customers; these customers are loyal yet they have still a low policy density so they are most suitable for cross- and upsell with our Next Best Policy solution.

Enhancing Accessibility and Usability

Seamless Integration with Microsoft Platform

Built on Microsoft PowerApps, our Defend App® seamlessly integrates into your existing ecosystem, including Office365, Outlook, Teams, and Azure Cloud. Enjoy single sign-on access and full integration with familiar Microsoft tools

Why Choose The Onesurance AI Engine?

Modular Design and Quick Implementation

Start with churn management and expand to other modules as needed. Leverage pre-optimized models without the need for extensive development.

Expertise, Quality, and Transparency

Benefit from our team of data scientists ensuring high-quality, accurate predictions. Our algorithms are explainable and meet ethical data standards.

Cost Control and Scalability

Pay only for the modules you use, with transparent business case calculations. Scale easily without additional internal resources.

Complementary Services and Optimal Integration

We handle data transformation, security, management, and architecture, ensuring optimal integration with your existing systems and processes.

Get in Touch

Discover What The Onesurance AI Engine Can Do for You

Ready to transform your insurance business with data-driven insights and advanced AI capabilities? Contact us today to learn more about how Onesurance AI Engine can help you achieve your goals and stay ahead of the competition.